Receivables Template Excel

Receivables Template Excel - Ar is listed on the balance. Accounts receivable (ar) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet. These items are collectively labeled as trade receivables. Receivables refer to the money owed to a company by its customers for goods or services provided on credit, recorded as assets, whereas accounts payable refers to the. Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. Accounts receivable (ar) represents the amount of money that customers owe your company for products or services that have been delivered. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. Accounts receivable is the outstanding invoices a company has or money owed by client to the company. The term receivables is short for accounts receivable (a/r), which are amounts bought by customers for a company's goods and services. The primary sources of receivables are transactions with customers in which they are allowed to pay later. This money is typically collected after a few weeks and is. The term receivables is short for accounts receivable (a/r), which are amounts bought by customers for a company's goods and services. Accounts receivable (ar) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet. Ar is listed on the balance. These items are collectively labeled as trade receivables. The term refers to accounts a business has the right receive because of. The primary sources of receivables are transactions with customers in which they are allowed to pay later. Accounts receivable (a/r) or receivables are the amounts customers owe to the company for the goods delivered or services provided. Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. Accounts receivable, often abbreviated a/r, is the amount of money that customers currently owe to the company for goods or services that were purchased on credit. Accounts receivable is the outstanding invoices a company has or money owed by client to the company. Accounts receivable (ar) represents the amount of money that customers owe your company for products or services that have been delivered. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past.. Accounts receivable is the outstanding invoices a company has or money owed by client to the company. The primary sources of receivables are transactions with customers in which they are allowed to pay later. These items are collectively labeled as trade receivables. Receivables refer to the money owed to a company by its customers for goods or services provided on. Accounts receivable (ar) represents the amount of money that customers owe your company for products or services that have been delivered. Accounts receivable is the outstanding invoices a company has or money owed by client to the company. Accounts receivable (ar) is an accounting term for money owed to a business for goods or services that it has delivered but. This money is typically collected after a few weeks and is. Likewise, the company makes the journal entry for. Accounts receivable, often abbreviated a/r, is the amount of money that customers currently owe to the company for goods or services that were purchased on credit. Accounts receivable (a/r) or receivables are the amounts customers owe to the company for the. The term refers to accounts a business has the right receive because of. Receivables refer to the money owed to a company by its customers for goods or services provided on credit, recorded as assets, whereas accounts payable refers to the. This money is typically collected after a few weeks and is. Accounts receivable (a/r) or receivables are the amounts. The term receivables is short for accounts receivable (a/r), which are amounts bought by customers for a company's goods and services. Accounts receivable, often abbreviated a/r, is the amount of money that customers currently owe to the company for goods or services that were purchased on credit. Accounts receivable is any amount of money your customers owe you for goods. Accounts receivable (a/r) or receivables are the amounts customers owe to the company for the goods delivered or services provided. This money is typically collected after a few weeks and is. Ar is listed on the balance. The term receivables is short for accounts receivable (a/r), which are amounts bought by customers for a company's goods and services. Accounts receivable. Ar is listed on the balance. Accounts receivable (ar) represents the amount of money that customers owe your company for products or services that have been delivered. Accounts receivable (a/r) or receivables are the amounts customers owe to the company for the goods delivered or services provided. Accounts receivable (ar) is an accounting term for money owed to a business. Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. These items are collectively labeled as trade receivables. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the. The term refers to accounts a business has the right receive because of. Accounts receivable, often abbreviated a/r, is the amount of money that customers currently owe to the company for goods or services that were purchased on credit. Accounts receivable (ar) represents the amount of money that customers owe your company for products or services that have been delivered.. Accounts receivable is the outstanding invoices a company has or money owed by client to the company. Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. The primary sources of receivables are transactions with customers in which they are allowed to pay later. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. This money is typically collected after a few weeks and is. Accounts receivable (ar) represents the amount of money that customers owe your company for products or services that have been delivered. Ar is listed on the balance. These items are collectively labeled as trade receivables. The term receivables is short for accounts receivable (a/r), which are amounts bought by customers for a company's goods and services. Accounts receivable (a/r) or receivables are the amounts customers owe to the company for the goods delivered or services provided. Accounts receivable, often abbreviated a/r, is the amount of money that customers currently owe to the company for goods or services that were purchased on credit. Receivables refer to the money owed to a company by its customers for goods or services provided on credit, recorded as assets, whereas accounts payable refers to the.Free Receivables And Payables Detailed List Templates For Google Sheets

Free Account Receivables Templates For Google Sheets And Microsoft

Free Sales Receivables Templates For Google Sheets And Microsoft Excel

Free Sales Receivables Templates For Google Sheets And Microsoft Excel

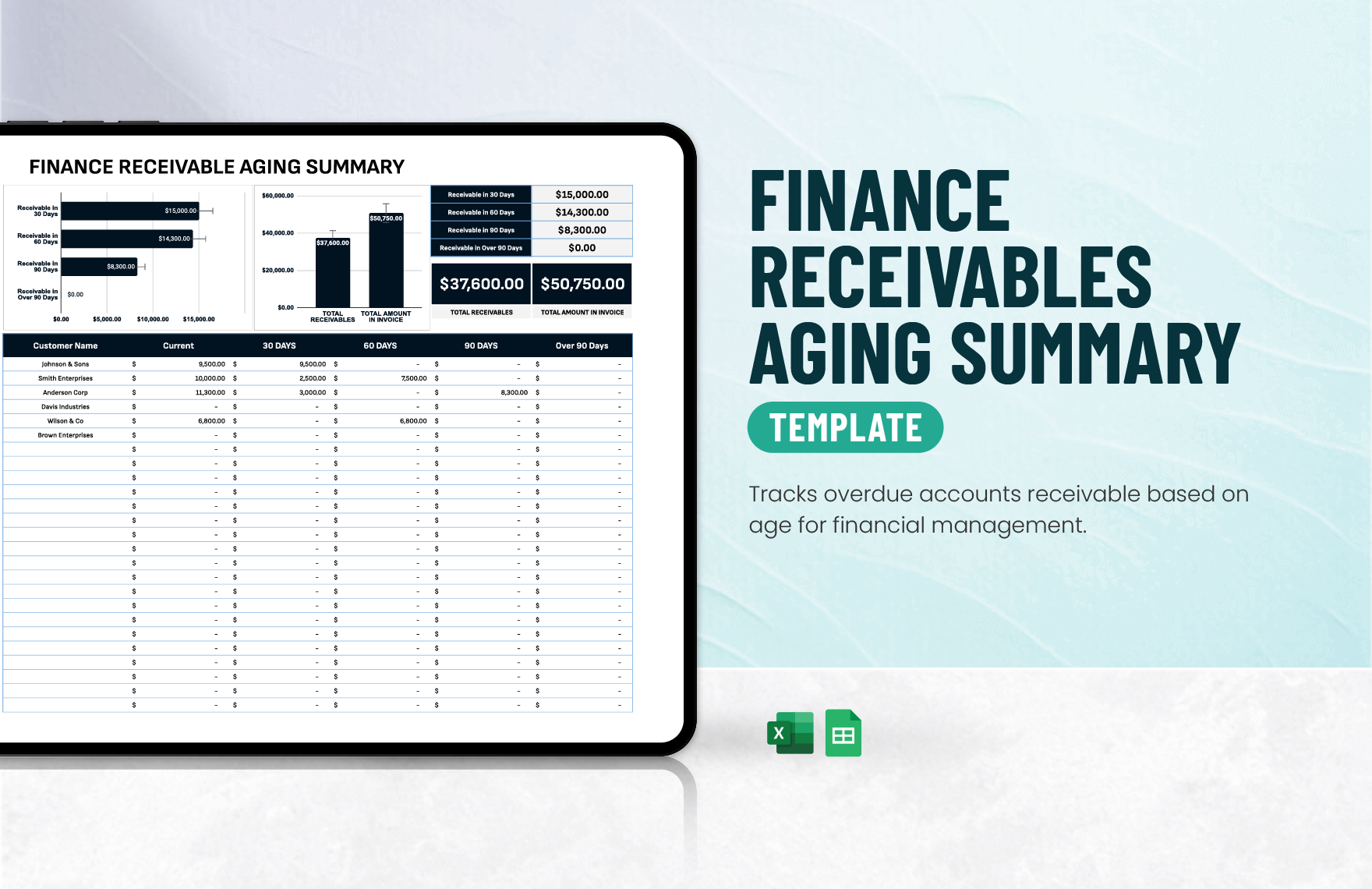

Editable Summary Templates in Excel to Download

Free Sales Receivables Templates For Google Sheets And Microsoft Excel

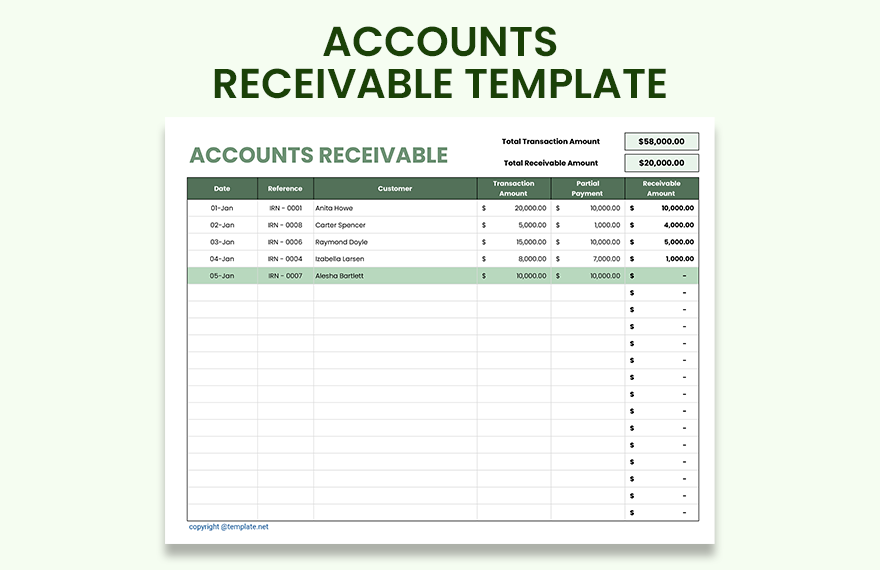

Accounts Receivable Excel Template

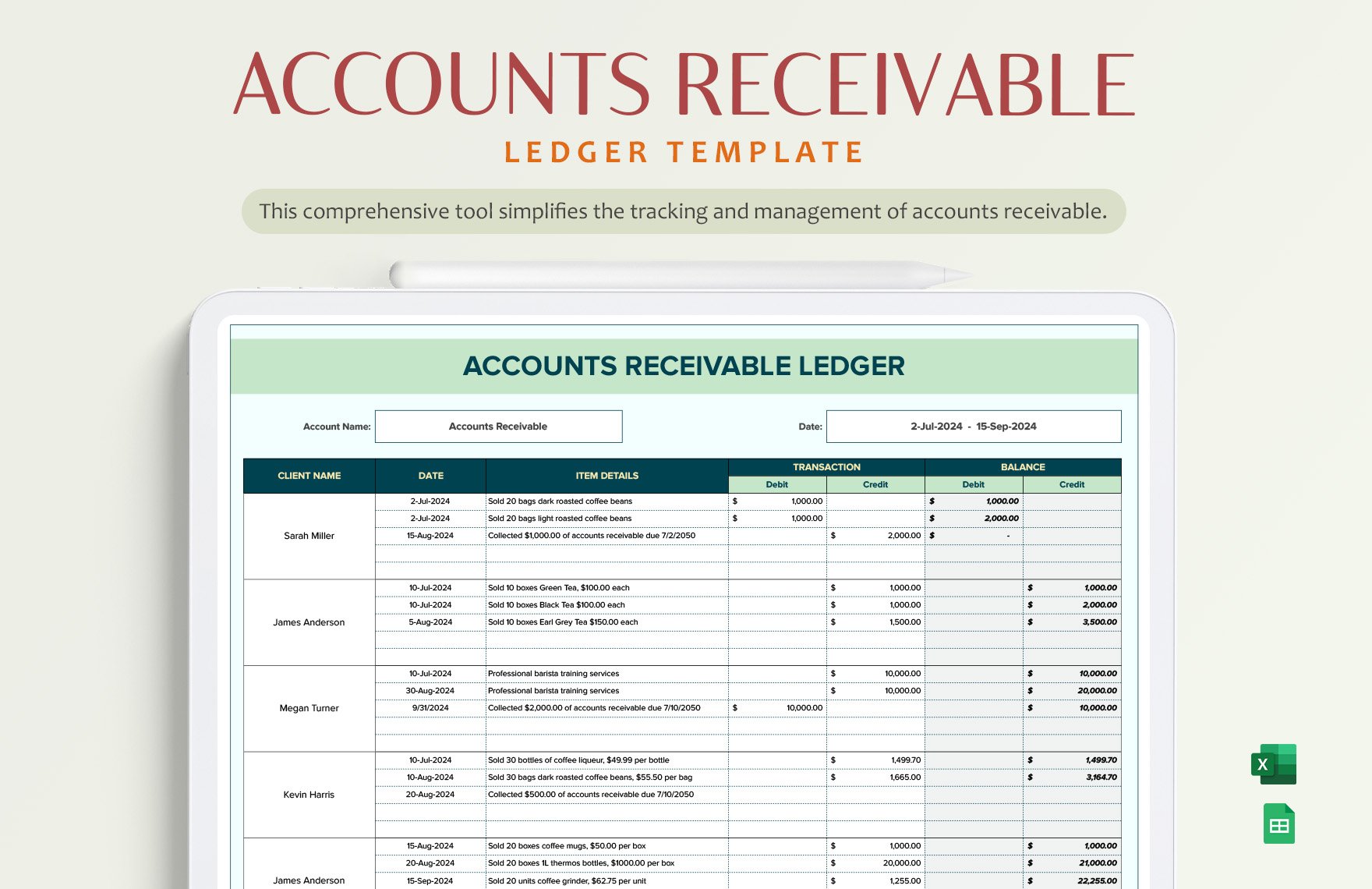

Free Bookkeeping Templates in Excel to Download

EXCEL of Engineer Project Receivables & Payables Form.xlsx WPS Free

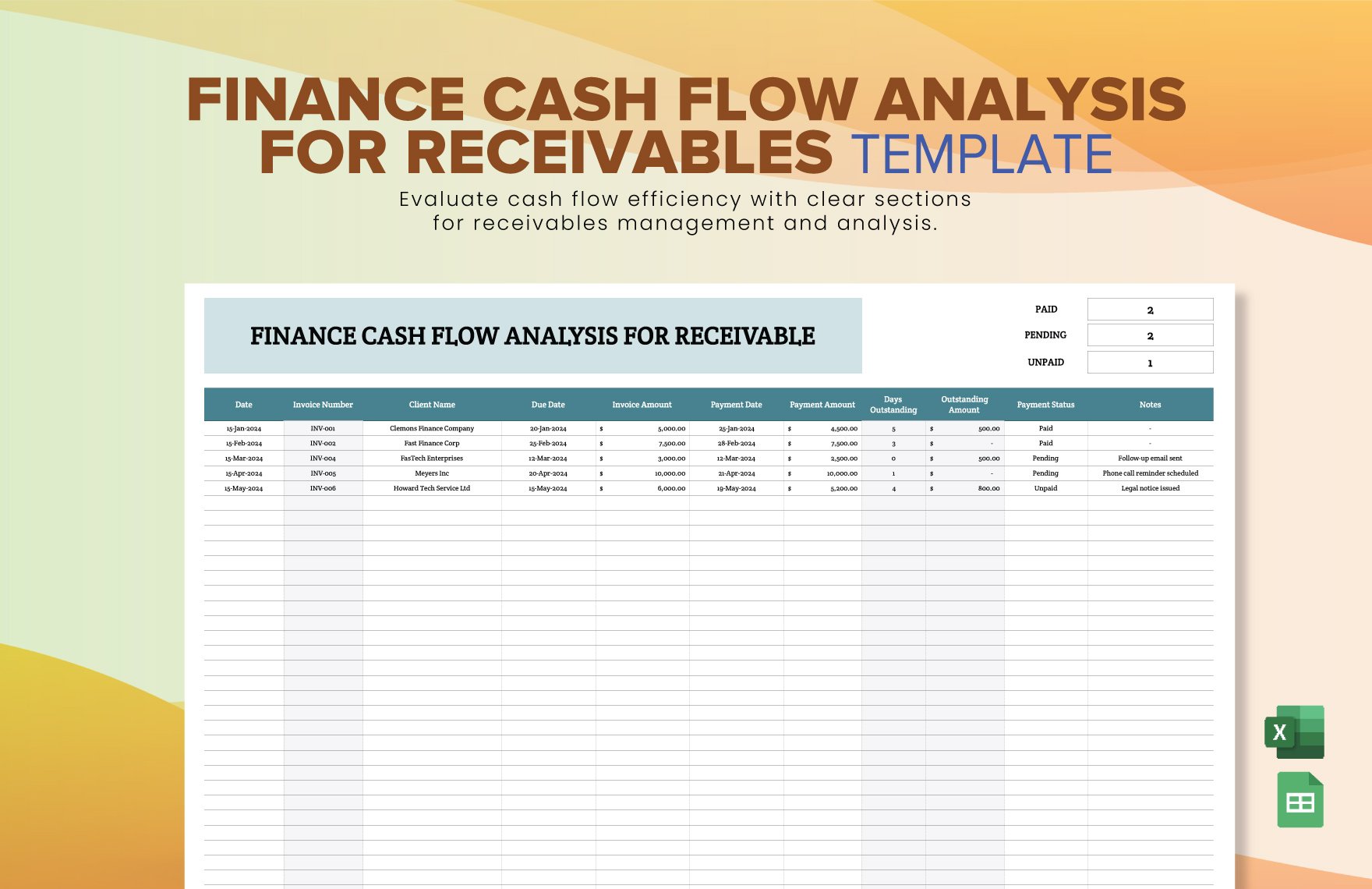

Editable Cash Templates in Excel to Download

The Term Refers To Accounts A Business Has The Right Receive Because Of.

Accounts Receivable (Ar) Is An Accounting Term For Money Owed To A Business For Goods Or Services That It Has Delivered But Not Been Paid For Yet.

Likewise, The Company Makes The Journal Entry For.

Related Post: