Depreciation Schedule Template

Depreciation Schedule Template - Depreciation is the systematic reduction of the cost of a fixed asset. It is an allowance for the wear and tear,. The cost of the asset should be deducted over. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year. There are four main methods of. After an asset is purchased, a. But instead of doing it all in one tax year, you write off parts of it over time. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. It is an allowance for the wear and tear,. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. It is accounted for throughout the. After an asset is purchased, a. The loss on an asset that arises from depreciation. Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year. It is used to match a portion of the cost of a fixed asset to the revenue it generates. But instead of doing it all in one tax year, you write off parts of it over time. There are four main methods of. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. It is an allowance for the wear and tear,. It. But instead of doing it all in one tax year, you write off parts of it over time. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. The cost of the asset should be deducted over. It is accounted for throughout the. Depreciation allows a business. It is accounted for throughout the. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is the process of deducting the total cost of something expensive you bought for your business. Here are the different depreciation methods and. Depreciation is the reduction in the value of a. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Depreciation is the process of deducting the total. Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. The cost of the asset should be deducted over. There are. There are four main methods of. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Depreciation is the reduction in the value of a fixed. It is used to match a portion of the cost of a fixed asset to the revenue it generates. It is an allowance for the wear and tear,. The cost of the asset should be deducted over. But instead of doing it all in one tax year, you write off parts of it over time. It is accounted for throughout. Here are the different depreciation methods and. It is accounted for throughout the. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. It is an allowance for the wear and tear,. Depreciation allows a business to allocate the. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Depreciation is the process of deducting the total cost of something expensive you bought for your business. It is accounted for throughout the. Depreciation allows a business to allocate. It is used to match a portion of the cost of a fixed asset to the revenue it generates. It is an allowance for the wear and tear,. Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year. Depreciation in accounting and bookkeeping is. After an asset is purchased, a. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Here are the different depreciation methods and. Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. It is used to match a portion of the cost of a fixed asset to the revenue it generates. It is accounted for throughout the. There are four main methods of. Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. The loss on an asset that arises from depreciation. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. The cost of the asset should be deducted over. It is an allowance for the wear and tear,.Notion Depreciation Schedule Template Template Road

Depreciation Schedule Template Customizable Layout Templates Hub

Depreciation Schedule Template 9+ Free Word, Excel, PDF Format Download!

Notion Depreciation Schedule Template Template Road

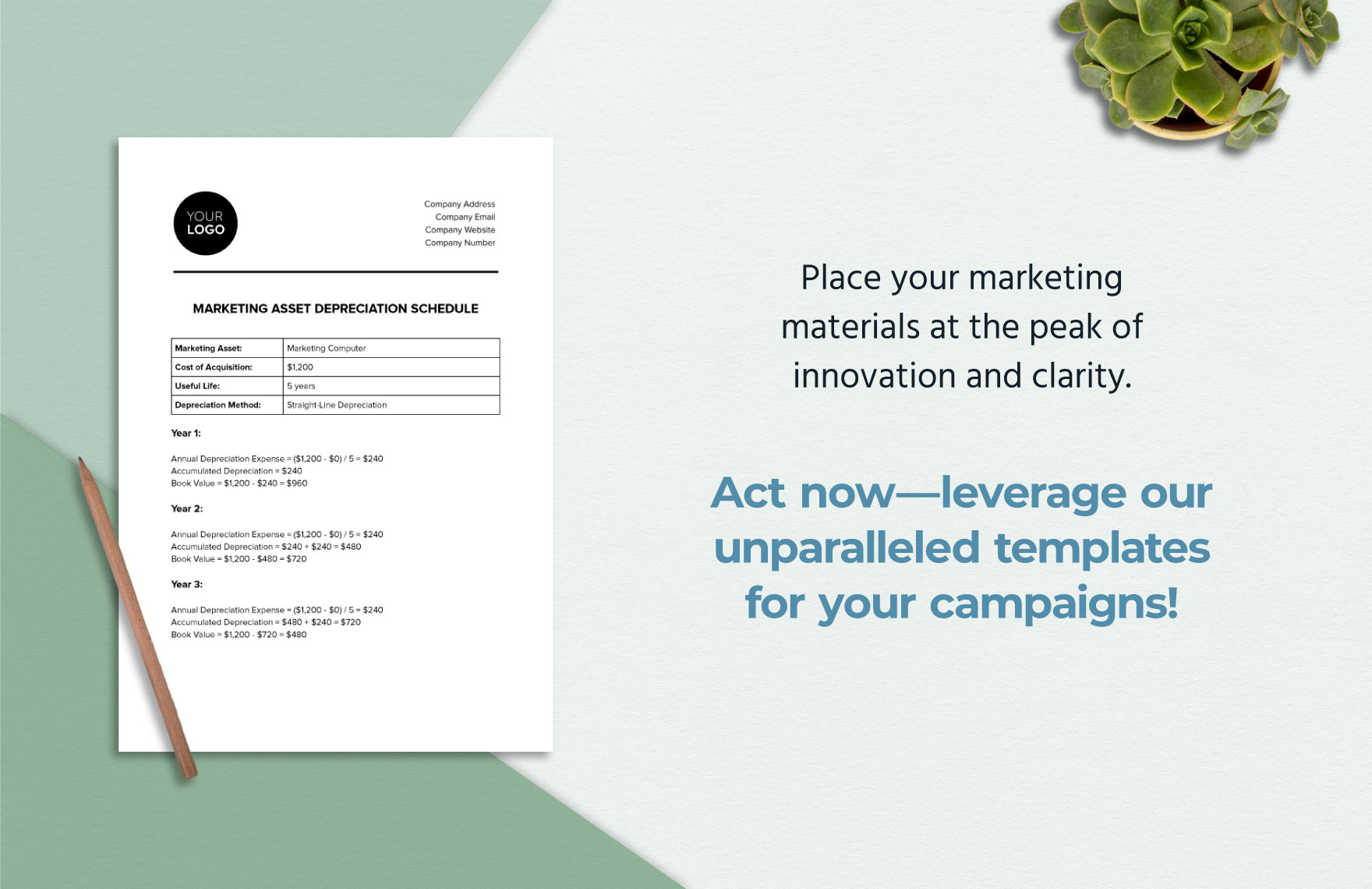

Marketing Asset Depreciation Schedule Template in PDF, Word, Google

Depreciation Schedule Template Editable Format Templates Hub

Marketing Asset Depreciation Schedule Template in PDF, Word, Google

Depreciation Schedule Template 9+ Free Word, Excel, PDF Format Download!

Printable Depreciation Schedule Template Template Fixed Assets

Accounting Depreciation Schedule Form Template Edit Online & Download

Depreciation Is The Systematic Reduction Of The Cost Of A Fixed Asset.

Depreciation Is The Reduction In The Value Of A Fixed Asset Due To Usage, Wear And Tear, The Passage Of Time, Or Obsolescence.

Depreciation Is The Process Of Deducting The Total Cost Of Something Expensive You Bought For Your Business.

But Instead Of Doing It All In One Tax Year, You Write Off Parts Of It Over Time.

Related Post: