Debt Schedule Template

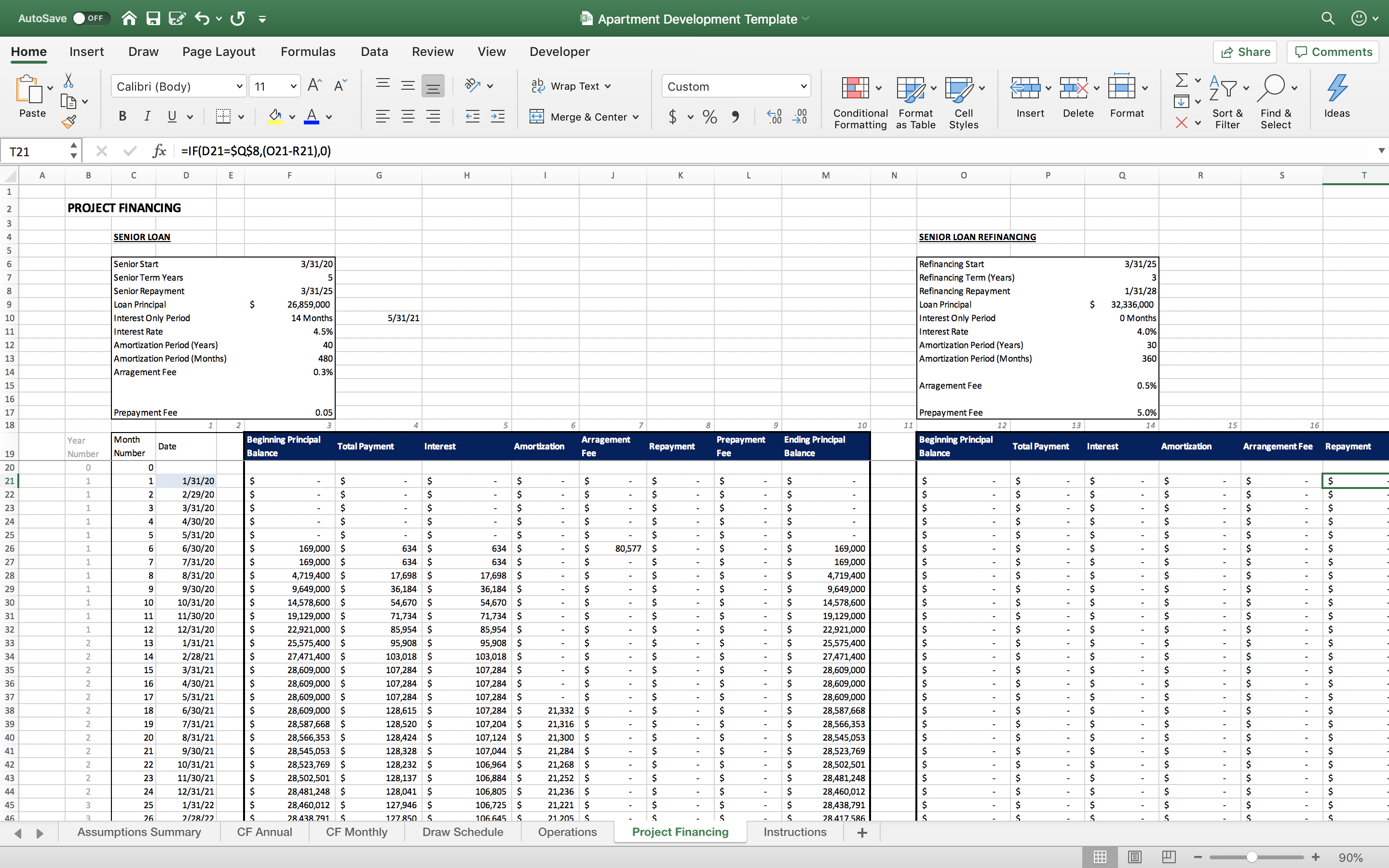

Debt Schedule Template - It’s designed for business owners, accountants, and financial managers who need to track long. This template allows you to record debt and interest payments over time. Download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. A business debt schedule is a table that lists your monthly debt payments in order of maturity. Easily track and manage your business debts with our free business debt schedule template. Developing a debt payment schedule template can help you manage your debt repayment. A debt schedule outlines a company’s outstanding debt obligations, including details such as loan types, interest rates, payment schedules, and maturity dates. By having a structured plan, it is easier to keep up with payments, reduce interest,. This debt schedule template is built to organize that information in a clean, editable format. With a debt schedule template, you can monitor debt balances, calculate interest expenses, track payment schedules, analyze debt maturity profiles, and generate financial projections for. This template helps you maintain your important business reputation,. By having a structured plan, it is easier to keep up with payments, reduce interest,. This debt schedule template is built to organize that information in a clean, editable format. A debt schedule outlines a company’s outstanding debt obligations, including details such as loan types, interest rates, payment schedules, and maturity dates. It helps you track cash flow and make informed, strategic decisions about paying. With a debt schedule template, you can monitor debt balances, calculate interest expenses, track payment schedules, analyze debt maturity profiles, and generate financial projections for. Developing a debt payment schedule template can help you manage your debt repayment. Download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. This debt schedule excel template helps track loans, interest payments, and repayment schedules with automated calculations for clear financial planning. This template will guide you in detailing a company’s. Developing a debt payment schedule template can help you manage your debt repayment. This template helps you maintain your important business reputation,. With a debt schedule template, you can monitor debt balances, calculate interest expenses, track payment schedules, analyze debt maturity profiles, and generate financial projections for. This template allows you to record debt and interest payments over time. This. It’s designed for business owners, accountants, and financial managers who need to track long. This debt schedule template is built to organize that information in a clean, editable format. This template helps you maintain your important business reputation,. Easily track and manage your business debts with our free business debt schedule template. The business debt schedule template is designed for. It helps you track cash flow and make informed, strategic decisions about paying. This template helps you maintain your important business reputation,. This debt schedule excel template helps track loans, interest payments, and repayment schedules with automated calculations for clear financial planning. With a debt schedule template, you can monitor debt balances, calculate interest expenses, track payment schedules, analyze debt. This template allows you to record debt and interest payments over time. A business debt schedule is a table that lists your monthly debt payments in order of maturity. It’s designed for business owners, accountants, and financial managers who need to track long. This debt schedule excel template helps track loans, interest payments, and repayment schedules with automated calculations for. With a debt schedule template, you can monitor debt balances, calculate interest expenses, track payment schedules, analyze debt maturity profiles, and generate financial projections for. Download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. It helps you track cash flow and make informed, strategic decisions about paying. This debt schedule excel template helps. Easily track and manage your business debts with our free business debt schedule template. This template will guide you in detailing a company’s. It helps you track cash flow and make informed, strategic decisions about paying. The business debt schedule template is designed for small businesses to maintain accurate tracking of those debts. A business debt schedule is a table. A debt schedule outlines a company’s outstanding debt obligations, including details such as loan types, interest rates, payment schedules, and maturity dates. Easily track and manage your business debts with our free business debt schedule template. A business debt schedule is a table that lists your monthly debt payments in order of maturity. It helps you track cash flow and. A business debt schedule is a table that lists your monthly debt payments in order of maturity. This template helps you maintain your important business reputation,. This debt schedule excel template helps track loans, interest payments, and repayment schedules with automated calculations for clear financial planning. Download our debt schedule template and learn to effectively manage and analyze your company’s. Download wso's free debt schedule model template below! The business debt schedule template is designed for small businesses to maintain accurate tracking of those debts. A debt schedule outlines a company’s outstanding debt obligations, including details such as loan types, interest rates, payment schedules, and maturity dates. Easily track and manage your business debts with our free business debt schedule. With a debt schedule template, you can monitor debt balances, calculate interest expenses, track payment schedules, analyze debt maturity profiles, and generate financial projections for. Download wso's free debt schedule model template below! A debt schedule outlines a company’s outstanding debt obligations, including details such as loan types, interest rates, payment schedules, and maturity dates. This debt schedule excel template. It’s designed for business owners, accountants, and financial managers who need to track long. Developing a debt payment schedule template can help you manage your debt repayment. This debt schedule excel template helps track loans, interest payments, and repayment schedules with automated calculations for clear financial planning. This debt schedule template is built to organize that information in a clean, editable format. It helps you track cash flow and make informed, strategic decisions about paying. A debt schedule outlines a company’s outstanding debt obligations, including details such as loan types, interest rates, payment schedules, and maturity dates. Easily track and manage your business debts with our free business debt schedule template. This template allows you to record debt and interest payments over time. Download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. Download wso's free debt schedule model template below! This template helps you maintain your important business reputation,. This template will guide you in detailing a company’s.Real Estate Development Model Template 1 Best Real Estate

Progress Payment Payment Schedule Excel Template WebQS

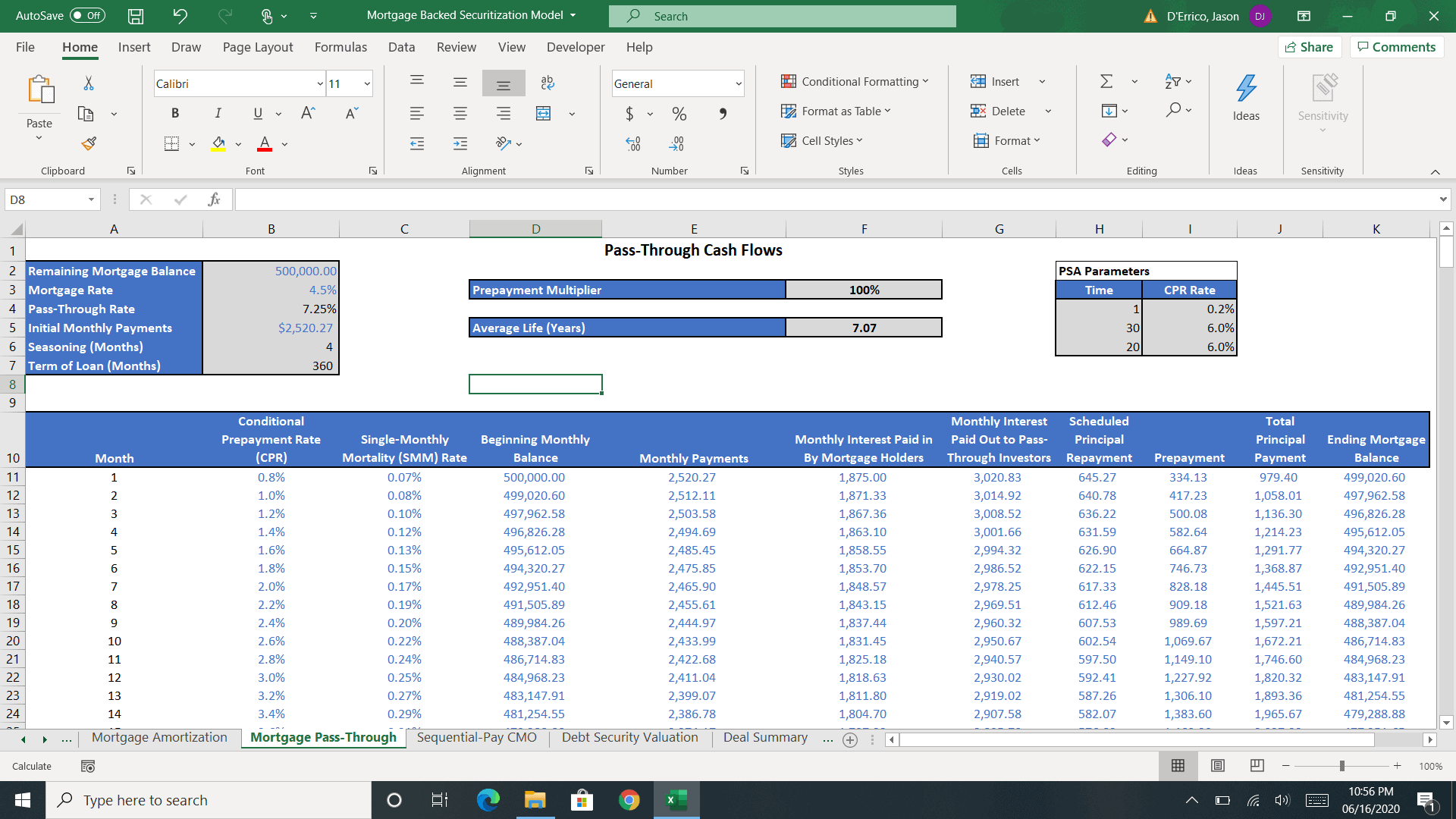

Debt Securitization Model Template eFinancialModels

Vessel Voyage Excel Financial Model Projection Template Excel XLS

Taylor Gendron posted on LinkedIn

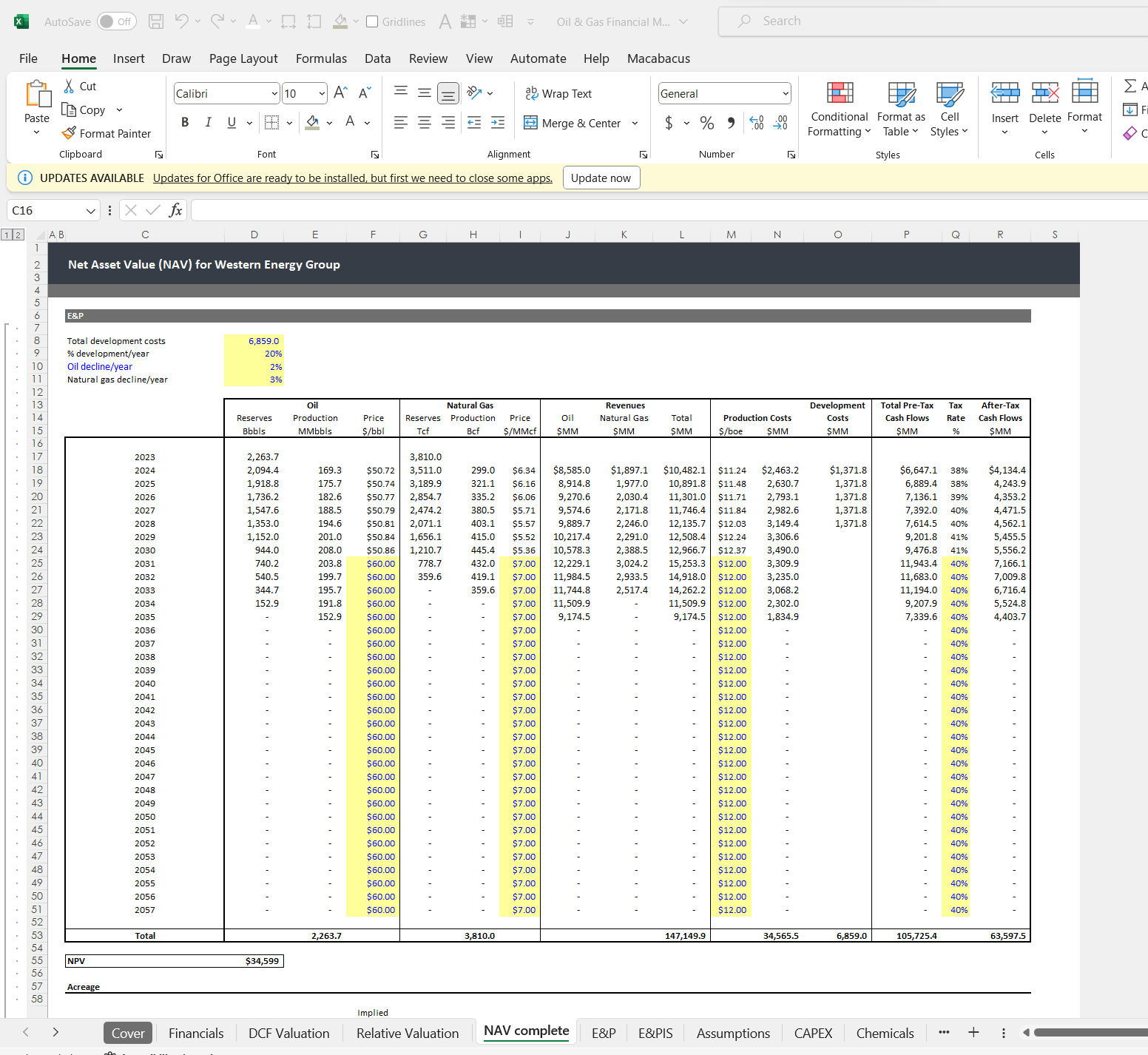

Oil & Gas Financial Model Excel Template Eloquens

Complete Debt Schedule Template

Watermelon Farming Excel Financial Model Projection Template Excel XLS

Real Estate Development Pro Forma Template Excel Free

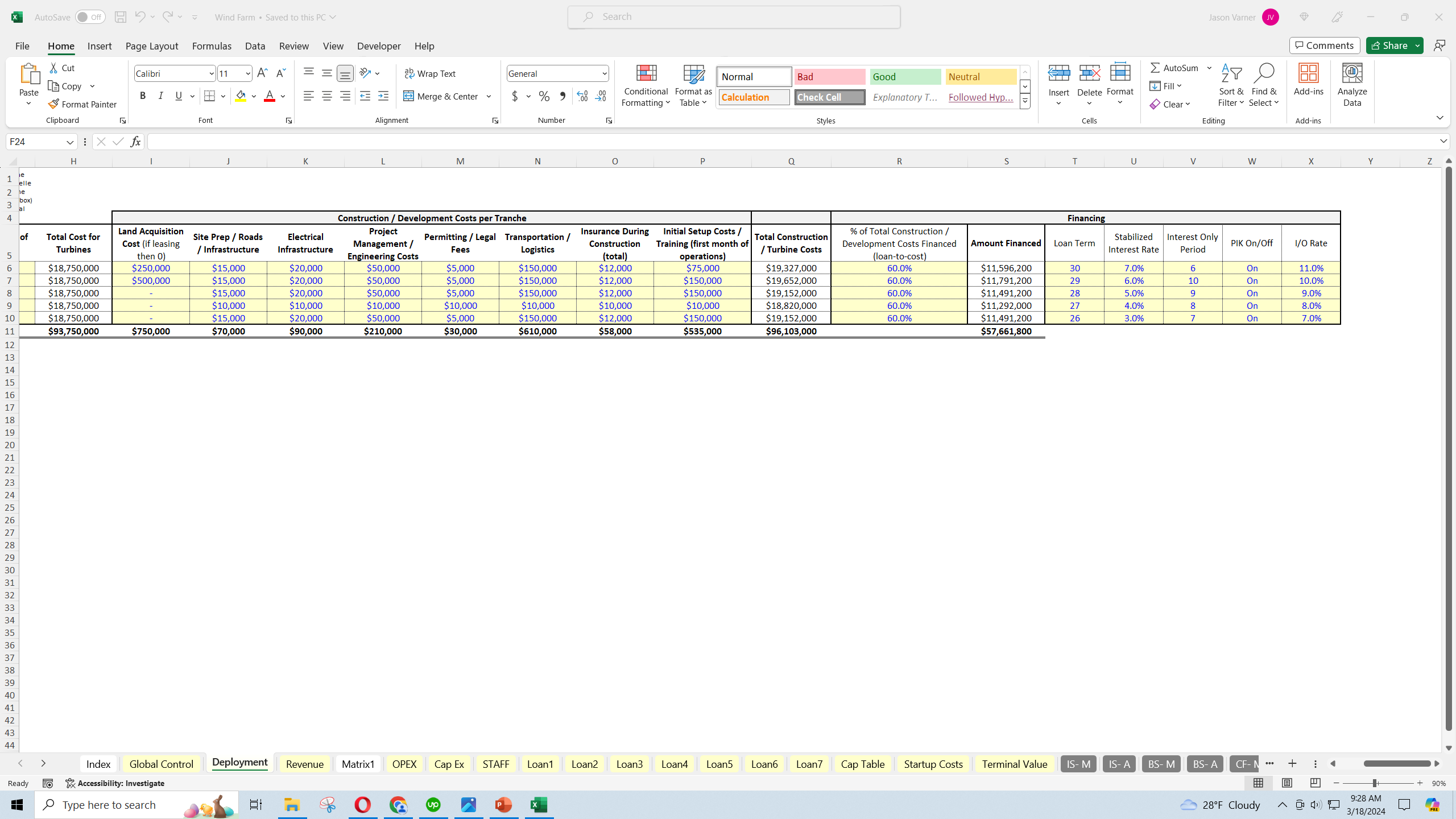

Wind Farm Financial Feasibility Study Template Excel XLS

With A Debt Schedule Template, You Can Monitor Debt Balances, Calculate Interest Expenses, Track Payment Schedules, Analyze Debt Maturity Profiles, And Generate Financial Projections For.

The Business Debt Schedule Template Is Designed For Small Businesses To Maintain Accurate Tracking Of Those Debts.

By Having A Structured Plan, It Is Easier To Keep Up With Payments, Reduce Interest,.

A Business Debt Schedule Is A Table That Lists Your Monthly Debt Payments In Order Of Maturity.

Related Post: